Tax Support Centres for assisting low-income individuals consolidate their growth in Latin American universities

EUROsociAL and Brazil's tax administration, the Receita Federal, promoted the creation of 130 university-based Accounting and Tax Support Centres in seven Latin America countries. 1,404 students have provided 26,000 free consultations to citizens

Alberto owns a shoe-repair shop in Mexico. Until recently, he was working informally. “I hadn't registered because I thought it was very complicated and that I'd have to pay a lot in taxes. But my nephew invited me to his university, and there they have a module where the students explained to me why it was a good idea to register. They supported me in registering and in calculating my taxes, and also explained to me that I didn't have to pay anything the first year”. Alberto is one of the 8,678 Mexican workers who have formalised their situation in Accounting and Tax Support Centres (NAF).

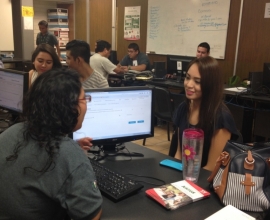

The NAFs are an experience borrowed from the Brazilian tax administration (the Receita Federal), a country with 60 institutions of higher education. Through the NAF, the tax administration trains university students on tax matters and professional ethics so that the students can later, during their community-service or work-study hours, under the supervision of their professors, advise low-income natural and legal persons at no charge. The community benefits from the help in resolving basic tax issues, while the administration fulfils its role of citizen and tax training. The university, for its part, strengthens its links to the community and simultaneously provides its students with up-to-date practical knowledge on the subject of taxes at no cost.

EUROsociAL, with the support of the Receita Federal, has promoted the expansion of the NAFs in Latin America. In little over two years, NAFs have been opened in 130 universities in Mexico, Bolivia, Ecuador, Costa Rica, Honduras, Guatemala and Chile. As of January 2016, 1,404 students have participated in this initiative, providing a total of 25,975 consultations to private citizens and small business owners. Mexico is the country where the NAFs have undergone the most outstanding growth, with centres operating in 105 institutions of higher education.

The experience of the NAFs was included in the book “Building Tax Culture, Compliance and Citizenship. A Global Source Book on Taxpayer Education”, a publication promoted by the OECD, EUROsociAL and the Institute for International Development.

In addition, the NAFs figure among the cooperation actions featured on the website of the European Year for Development and on Spanish National Radio's “Public Cooperation Around the World” programme.

With the aim of sharing experiences between different tax administrations, EUROsociAL has also promoted a NAF Network and designed a model for it to be standardised and evaluated.

The experience exchanges to promote the NAFs were held within the framework of the “Strengthening tax education programmes” line of work, which is being coordinated by FIIAPP.

FIIAPP